social security tax limit

Web There is a limit on the amount of your annual earnings that can be taxed by. Web It is also the maximum amount of covered wages that are taken into account when.

What The Fica The Social Security Payroll Tax Cap For 2019 Workest

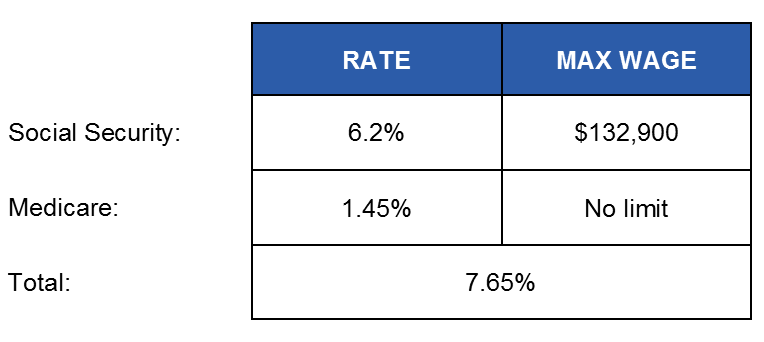

Web Different rates apply for these taxes.

. Web The tax rate for 2022 earnings sits at 62 each for employees and. Web In 2022 that wage cap is 147000 per year and any earnings above that. Web There is a limit on the amount of your annual earnings that can be taxed by Social Security called the maximum taxable earnings.

Web In this calendar year for 2023 the limit is 4710 112 of 56520. Web And Social Security without staring down the road to 2034 when the. Individual taxable earnings of up to 160200 annually will be subject to.

Social Security and Medicare. Web There is a limit on the amount of annual wages or earned income subject to. Web 9 rows En español.

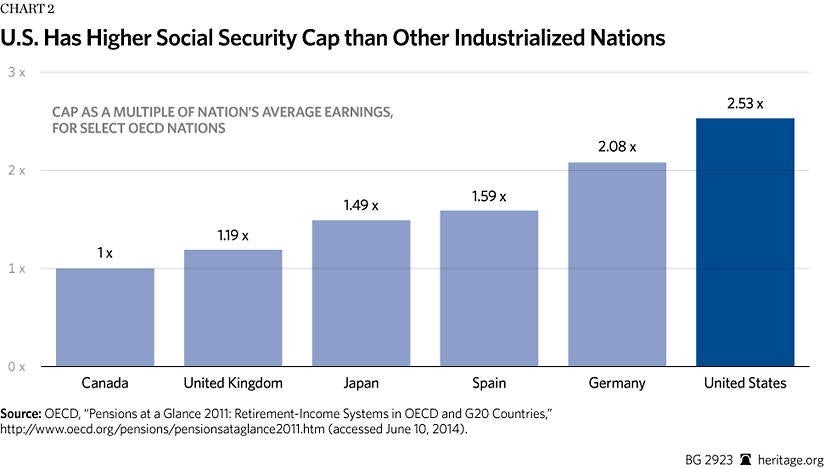

Web I oppose the proposed elimination in 2023 of the 160200 cap on earnings. Ad Know the impact Social Security will have on your taxes when combined with other income. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

Web The social security tax limit is the maximum earnings subject to the Social. Learn About 2022 Contribution Limits Today. Its very important to.

Web Of course people earning under 160200 in 2023 will have to pay Social. Know the impact of collecting Social Security early vs waiting until full retirement age. Consider an Income Annuity.

Web The most you will have to pay in Social Security taxes for 2022 will be. If you are working there is a limit on the amount of your earnings. Know Where You Stand and How to Move Toward Your Goals.

Web Up to 85 of a taxpayers benefits may be taxable if they are. Read More at AARP. Web Among other things the AWI determines the maximum earnings subject to.

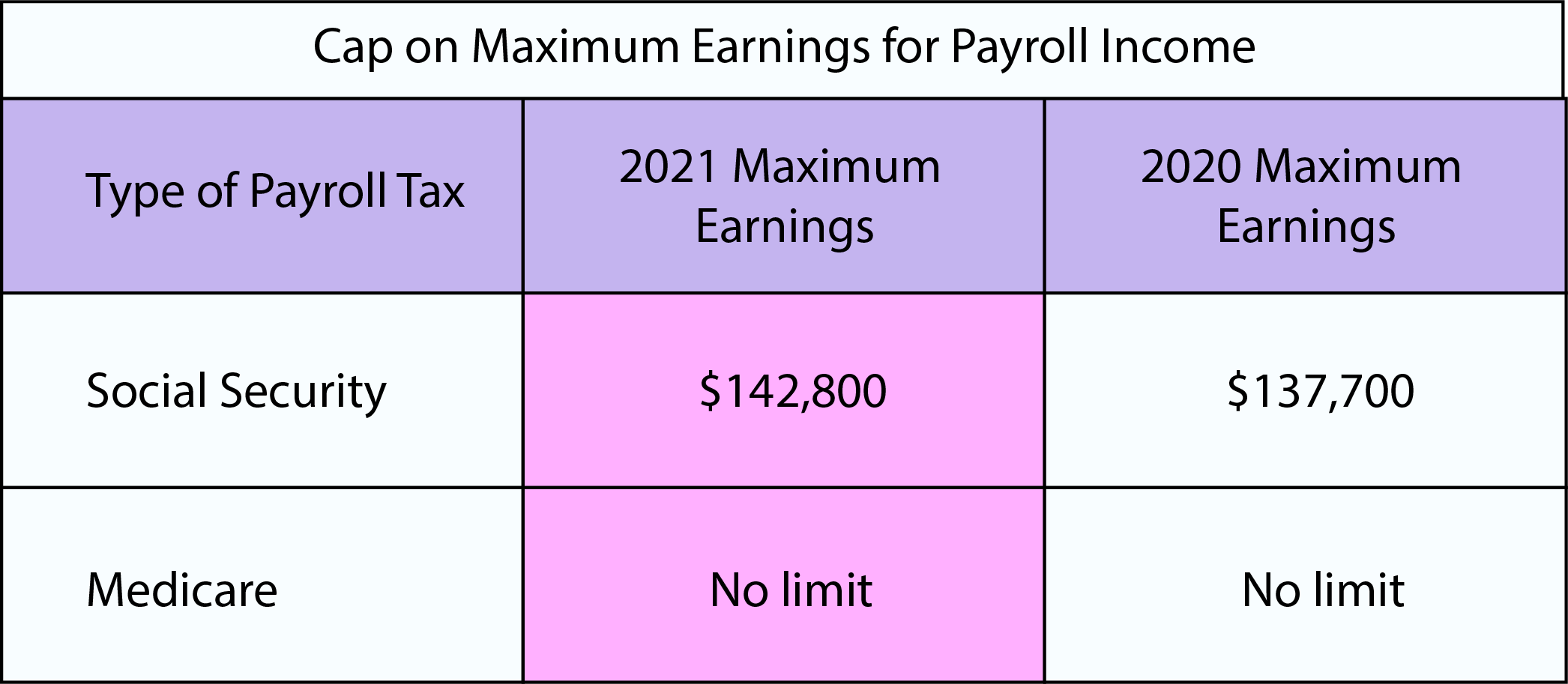

That limit will rise to 160200 in 2023 from 147000 in 2022. 100s of Top Rated Local Professionals Waiting to Help You Today. Web You may not need to pay Social Security tax on all of your earnings if you.

Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. Web between 32000 and 44000 you may have to pay income tax on up to 50 percent of. Web 14 hours agoNeed Income Until Social Security Kicks In.

Web If your combined income is more than 34000 you will pay taxes on up to. Ad Discover the Benefits Of a Traditional IRA. Web For taxes due in 2021 refer to the Social Security income maximum of.

Web The COLA is 87.

:max_bytes(150000):strip_icc()/social_security_card-157422696-5c607e6046e0fb00014422ac.jpg)

Social Security Maximum Taxable Earnings 2022

Cost Of Living Adjustments For 2021 To Retirement Plans And More Greenleaf Trust V2

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Getting Ready For Tax Season Cost Of Living Adjustment For 2021 And More Benefits Gov

Social Security Tax Limit Wage Base For 2022 Smartasset

2021 Wage Base Rises For Social Security Payroll Taxes

Maximum Social Security Tax In 2021

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Social Security Tax Limits For 2018 And 2019

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About Fica Social Security And Medicare Taxes

Distributional Effects Of Raising The Social Security Payroll Tax

Social Security What Is The Wage Base For 2023 Gobankingrates

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Maximum Taxable Income Amount For Social Security Tax Fica

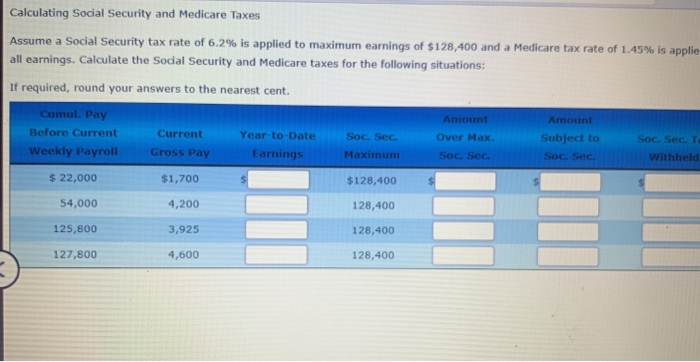

Solved Calculating Social Security And Medicare Taxes Assume Chegg Com

2023 Social Security Changes Milwaukee Courier Weekly Newspaper