hawaii general excise tax id number

Schedule A List of Unlicensed Suppliers and Subcontractors. The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE.

How To File And Pay Sales Tax In Hawaii Taxvalet

Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation.

. 37-1 General Excise Tax GET and Tax Announcement Nos. A good example of this is GE-999-999-9999-01. For example if you are paying for the tax due for general excise taxes for the month of January 2019 the date would be reported as 190131.

With Hawaii SalesTax IDs issued after the modernization project your first number will be GE followed by the subsequent 12 letters. Examples are GE numbers 9999-9999-01 and 99999-000-02. Hawaii Tax ID Number A tax account with a two alpha character tax type prefix followed by a ten digit Hawaii tax identification number 12 total characters.

It is unlikely that this ID number will be used for accounts that are similar to an income tax within the state of Hawaii. The Tax ID of the Hawaii State tells you how to create a General ExciseUse and County Surcharge Tax GET account in Hawaii. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET.

Perfect answer Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. Mal o HAWAII EPARTMENT O TAXATION P. How Do I Find My Hawaii General Excise Tax Number.

34 rows A. The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

Periodic General Excise Use Tax Return. After this time your license should be issued. If you have a Hawaii Tax ID you can add tax licenses such as employers withholding transient accommodations cigarette.

For more information see Tax Facts No. The general excise identification number is emailed to you within three to five days after you apply online. How Do I Find My Hawaii General Excise Tax Number.

If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. OX 125 HONOLULU HI 980-125 o l. An extension for an additional two 2 years may be.

If you have more than one DBA complete Form G-50 General Excise Branch License Maintenance Form to get a branch license for each DBA you use. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. See Hawaii Tax ID Number Changes for more information.

2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii. What Is My Hawaii General Excise Tax Id Number. Tax Services Hawaiʻi Tax Online.

How Long Does It Take To Get Ge Tax License In Hawaii. The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii. GE IN N.

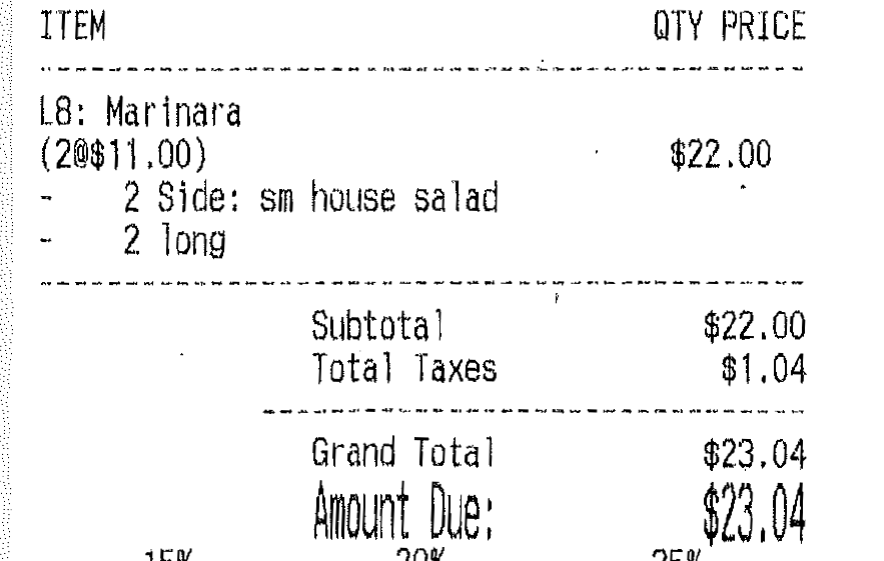

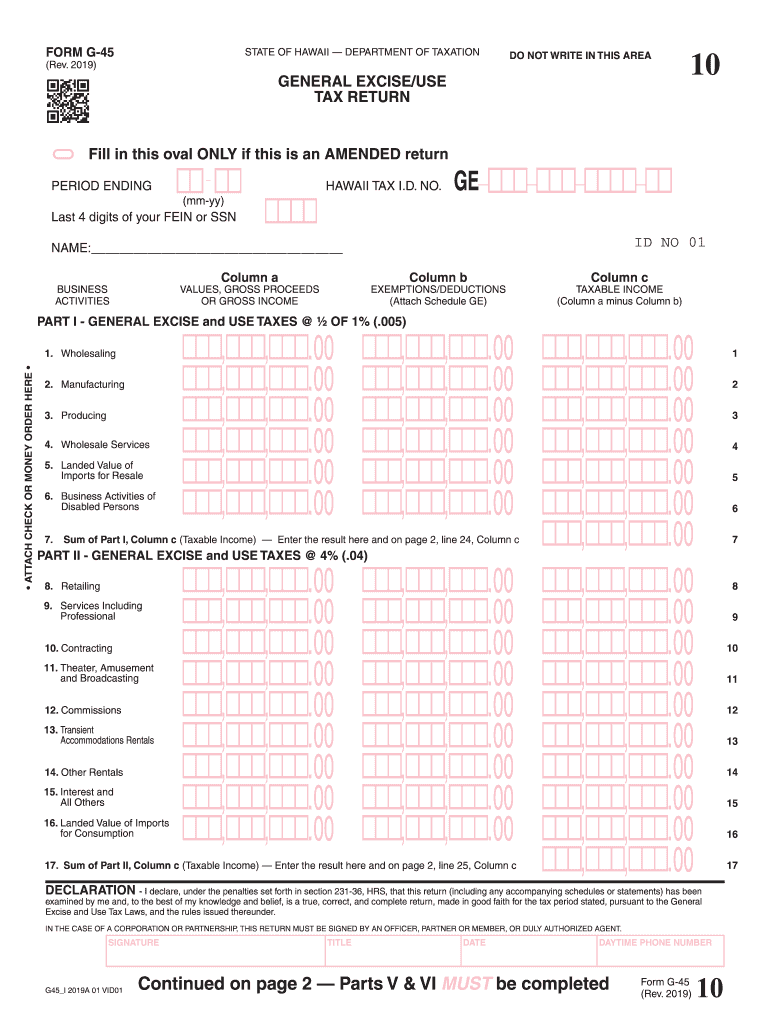

GENERAL EXCISEUSE TAX RETURN IOD NDIN HAWII TX ID. 2019 form for taxable periods beginning on or after January 1 2020. SIGNATURE TITLE DATE DAYTIME PHONE NUMBER Continued on page 2 Parts V VI MUST be completed.

Account IDs that contain sales tax information beginning with GE is to indicate that that the form contains tax form. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. In sales tax related account IDs the letter GE indicates the tax type.

Hawaii salestax ids that are issued after the modernization project begin with the letters ge and are followed by 12 digits. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO.

Inquiries can be directed to the Hawaii Taxpayer Services toll-free helpline at 1-800-222-3229. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits.

Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. After the modernization project Hawaii SalesTax IDs are issued which are issued after the modernization project begin with the letters GE and are followed by 12 digits. General ExciseUse Tax Exemption For Certified or Approved Housing Projects.

Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits. A retailers sales tax ID starts with GE which stands for general excise. Walking-in and mail applications usually take 15 to 25 working days to process.

General Excise Tax GET Information Department of Taxation tip taxhawaiigov. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. Check out the rest of this guide to find out who needs a General Excise.

Here is a sample GE code. The GE name for example would be999-99-9999-01. If you temporarily cease your business you can request to put on hold your general excise tax temporary accommodation tax rental vehicle tour vehicle and car-sharing vehicle surcharge as well as your withholding tax licences using Form L-9.

16 Can I add tax licenses to my Hawaii Tax ID. Hawaii SalesTax IDs following the modernization project are numbered GER and contain 12 digits with the words GE. Year month and day YYMMDD format.

General Excise Tax License Search. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Branch licenses are free.

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer

Hawaii General Excise Tax Services Tax Services Oahu

Hawaii General Excise Tax Everything You Need To Know

Hawaii General Excise Tax Everything You Need To Know

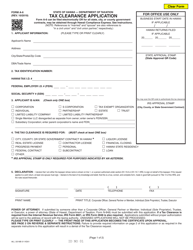

Tax Clearance Certificates Department Of Taxation

2019 2022 Form Hi Dot G 45 Fill Online Printable Fillable Blank Pdffiller

Hawaii State Tax Golddealer Com

How To Register For A Sales Tax Permit In Hawaii Taxvalet

Tax Preperation On Oahu Executive Accounting Solutions

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Licensing Information Department Of Taxation

Form A 6 Download Fillable Pdf Or Fill Online Tax Clearance Application Hawaii Templateroller

Pros And Cons Of Forming An Llc In Hawaii Learning Centers Llc Limited Liability Company

How To File And Pay Sales Tax In Hawaii Taxvalet

County Surcharge On General Excise And Use Tax Department Of Taxation

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals